The timing is right! Commercial bankers are looking for good loans. Many business owners are looking for liquidity and perhaps do not want to sell their businesses. If the Biden Administration gets its way, taxes on dividends and capital gains are not going to be lower for the foreseeable future. And interest rates are not expected to be lower in the future, as well.

Need appears to be meeting opportunity and it may be time for business owners to take some liquidity from their businesses and for commercial bankers to make some good loans to their customers, or if they present the idea right, to the customers of other bankers.

If yours is a family business, do all your shareholders always agree on the mix between dividends (current returns) and capital gains (future returns)? Whether a family business or not, do all your shareholders have the same goals for their ownership of your company’s shares? Probably not.

This post, in addition to being timely in terms of execution of leveraged share repurchases or leveraged share redemptions (or buybacks), warrants consideration by most closely held and family businesses over time. The transactions we discuss are not necessarily one-time events, but can be conducted over time and in sequence to help balance differing shareholder objectives and to provide shareholder liquidity and higher overall returns on their investments.

Corporate Finance for Private Businesses

Leveraged dividend recapitalizations and leveraged share repurchases are two corporate finance tools that are available to owners of closely held and family businesses. These tools can be used to create liquidity outside the ownership of private businesses or interests in them. These tools can be defined as:

- Leveraged dividend recapitalization. A company employs leverage (i.e., borrows money, most often from a commercial bank) to use to pay a one-time dividend pro rata to all owners. The transaction accelerates returns and provides liquidity for all owners and does not change the ownership structure.

- Leveraged share repurchase. A company employs leverage (i.e., borrows money, most often from a commercial bank) to repurchase a portion of its shares from selected owners. The transaction provides liquidity for one or selected owners and enhanced returns and enhanced relative ownership for the remaining owners as result of reducing the number of shares outstanding.

Interestingly, leveraged dividends and leveraged repurchases have very similar impacts on companies (assuming similar companies and same-sized transactions), but quite different impacts on the owners of the companies. Leveraged transactions are often talked about, but are seldom written about.

Chapters 9 and 10 of my book, “Unlocking Private Company Wealth,” provide a general discussion of leveraged dividend recaps and leveraged share repurchases and a detailed example of a leveraged share repurchase. In this post, we illustrate the impact of a leveraged share repurchase and a leveraged dividend on the same company. This analysis enables us to see the impact leverage has on the company and also, the different impacts the transactions have on owners.

Corporate finance principals are not the sole dominion of publicly traded companies and academicians. The same principals apply to every closely held and family business.

The Situation at Cash Cow, Inc.

Sales and EBITDA for Cash Cow, Inc., or “Cash Cow,” were $50 million and $13 million, respectively for the latest twelve months. The EBITDA margin of 26% is stellar, but growth has been slow, and reinvestment opportunities at Cash Cow’s cost of capital have not been abundant. The result is that Cash Cow accumulated about $40 million in excess assets over a period of years.

Last year, after finally responding to years of complaints from family members not working in the business, the board of directors declared and Cash Cow paid, a special distribution of $40 million to its shareholders. Following that distribution, Cash Cow’s balance sheet remains strong, but there is little excess liquidity. The shareholders were obviously pleased with this distribution, which was a real treat relative to the normal dividend of $1.0 million per year.

Cash Cow’s CEO attended one of my webinars in which I talked about leveraged dividend recaps and leveraged share repurchases and their abilities to accelerate returns to some or all owners and to enhance returns as well. The CEO is a substantial shareholder and he thought that he wouldn’t mind some additional liquidity from selling some shares or from another dividend. He asked me to explain how both transactions might work for Cash Cow and the impact of a significant transaction, but not too large, on the company itself and for the shareholders.

The Potential Transactions

We value Cash Cow, with $13 million of EBITDA, at a multiple of about 6.0x EBITDA, which provides an enterprise value of $77 million, and an equity value of $79 million, assuming debt is zero and cash is $2.0 million.

The book value of equity for the business is $70 million. There are 1.0 million shares (or units) outstanding. Given the company’s history, I suggested that a transaction should not exceed about 40% of the equity value, whether in a repurchase or leveraged dividend transaction. The CEO asked me to provide a comparison at the 40% of equity value level for the board to consider. Based on an equity value of $79 million (we will see this momentarily), each transaction would be a $31.6 million deal for the shareholders.

There is $2 million of cash on the balance sheet, and it will be committed to the deal(s), so the company will borrow $29.6 million for the potential leveraged dividend and share repurchase transactions. With debt rising from zero to $29.6 million, bankers will be interested in the impact that this new leverage will have on Cash Cow under either transaction.

The assumed interest rate on the new debt is at 6.0%. Further, we assume that the blended federal and state tax rate for the business is 26% (on a C-corporation equivalent basis). That’s the rate for now, at least. The assumptions are set out in the four tables below, together with relevant calculations of the impact of the leveraged share repurchase and the leveraged dividend recap.

The use of cash and leverage for both the leveraged dividend recap and the leveraged share repurchase are identical. One key difference in the two transactions is seen on Line 2 above.

With the leveraged share repurchase, the number of shares is reduced by 400 thousand (40%) from the beginning shares of 1.0 million. With the leveraged dividend recap, there is no change in the number of shares. These differences will be examined as we proceed.

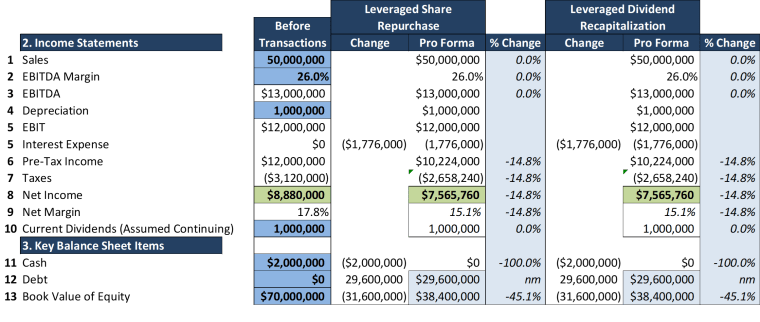

Cash Cow’s Pro Forma Balance Sheet and the Income Statement

The second table shows a summary of the impact of the two transactions on the balance sheet and the income statement of Cash Cow. The first thing to note in Lines 1-3 below is that the transactions have no impact on sales or EBITDA. This makes sense, because (reasonable) leverage should have no impact on sales or gross earnings, or EBITDA and EBIT.

At Lines 3 and 5 below, we see that both transactions create pro forma interest expense of $1.776 million, which lowers pre-tax earnings by an equivalent amount. Pre-tax income under both transactions is identical at $10.224 million, as seen on Line 6.

After taxes, pro forma net income falls from $8.9 million to $7.6 million (Line 8), and the net margin falls from 17.8% to 15.1%. The decline in net income in both transactions is the direct result of the interest expense associated with the new leverage. Cash Cow has been paying a dividend of $1.0 million per year and plans to continue to pay that dividend following the transaction(s).

Looking at key balance sheet items above, we see that pro forma cash is reduced to zero under both scenarios, and that debt is increased by the borrowing amount of $29.6 million. The book value of equity is reduced from $70 million to $38.4 million in both instances, or by the transaction amounts of $31.6 million.

The impact of a leveraged dividend and a leveraged share repurchase are equivalent at the Cash Cow level to this point. They are also identical in that someone(s) receives $31.6 million, either in the form of a share repurchase or a leveraged dividend payment.

A Banker’s Perspective

We now look at what happens to value and leverage from the viewpoint of the Cash Cow and its bankers, who will provide the leverage for the transactions. At Line 1 below in the following table, we see that enterprise value remains unchanged at $77 million (neither EBITDA nor the multiple changed).

What Will the Banker Want to See?

Market value of equity has been reduced, however, from $79 million prior to the transaction to $49.4 million on a pro forma basis for both a leveraged dividend recap and a leveraged share repurchase (Line 6 below).

Lines 7 to 12 provide a number of ratios that are often examined by bankers. The debt/equity ratio is 77.1%, which some might think a bit high. However, the debt/enterprise value ratio is a much lower 37.4% for both transactions, and most knowledgeable bankers who gain familiarity with Cash Cow would think so, as well.

EBITDA coverage of interest expense is a healthy 7.3x, again for both transactions. And debt/EBITDA is only 2.3x, which should be acceptable to most bankers. Asset intensive companies may be able to provide adequate collateralization to keep bankers happy without personal guaranties from selling or receiving owners. For less asset intensive companies, banks are more likely to cause their owners to sign personal guaranties for loans or portions of them.

As a shorthand to avoid a lengthy projection analysis, I calculated net income minus the expected dividend of $1.0 million, and then calculated the number of years of that figure it would take to pay down the principal on the loan. That figure, which does not consider growth prospects, is 4.5 years. That’s not a bad result. Should there be a cash flow issue in a given year? The Cash Cow could certainly forego paying its dividend.

The interesting thing about the analysis thus far is that, from the viewpoint of Cash Cow, a leveraged dividend and a leveraged share repurchase are essentially identical.

A Sale or a “Sale”?

Potential transactions like the two for Cash Cow provide liquidity for owners and do not require a sale of the business. They do, however, require a “sale” to the financing bank(s). A company desiring to engage in such transactions should consider retaining a financial advisor to assist in “selling” the company to the banks. The great part about this sale is that while the company is “sold” to the bank, it will take a note instead of your stock. When the note is paid off, the shareholders, except the ones who sold in a repurchase transaction, still have all their stock. And they can sell it later, or “sell” it again to the bank in the next leveraged transaction.

What About the Shareholders?

Leveraged dividends and leveraged share repurchases do, indeed, look different at the shareholder level. The differences relate to who gets returns from the company and when.

In a leveraged dividend recap, all owners get current cash from their investment pro rata to their ownership. In a leveraged share repurchase some owner (or owners) get cash now, in return for selling their shares, and the other remaining owners, must wait for their returns in the future. Regardless of the transaction, the shareholders must pay applicable taxes. I suggested to the CEO that we have a conversation with the Cash Cow’s CPA for an informed opinion regarding tax implications.

The next table provides key pro forma results for Cash Cow’s shareholders.

On Line 1 we highlight the fact that in a leveraged share repurchase, the number of shares is reduced. In this case, that reduction is fairly large at 40%. In the leveraged dividend case, the number of shares remains the same. The resulting differences in pro forma results flows from this basic difference.

To highlight the difference at the outset, suppose a Cash Flow owner holds 100 thousand of the original 1.0 million shares, or 10% of the stock prior to the transactions, and he does not sell shares in the transaction. With a leveraged share repurchase, that owner will still own 100 thousand shares of a total of 600 thousand shares, or 16.7% of the shares outstanding. Leveraged share repurchases increase the relative ownership of the non-selling owners.

Someone else got the current return, i.e., the owner(s) who sold their shares. Remaining owners following a leveraged share repurchase must wait for their returns, which will come in the future.

That same 10% owner would would continue to hold 10% of the shares following a leveraged dividend transaction, because there is no reduction in shares outstanding. However, he would have obtained a substantial current return from the dividend.

The differences between leveraged share purchases and leveraged dividend recaps from the viewpoint of Cash Flow’s owners are reflected beginning at Line 2:

- Line 2, Earnings Per Share (EPS). In a leveraged share repurchase, net earnings in dollar terms decline as seen above in the second table, but the number of shares declines disproportionately. Net income declined 14.8%, but the number of shares declined by 40%. EPS increased by 42% in the leveraged share repurchase, with EPS rising from a beginning $8.88 per share to $12.61 per share. In a leveraged dividend transaction, because net earnings decline (interest expense from leverage), EPS also decline, from $8.88 per share before to $7.57 per share pro forma. In the leveraged dividend recap, owners trade the large, current dividend for lower earnings (and dividend and growth potential because of debt service repayment, but offset by equity growth as the debt is repaid).

- Line 3, Value Per Share. Assuming that the price paid in a leveraged share repurchase is reasonable, value per share should rise. In this case, value increases from $79.00 per share to $131.67 per share. In a leveraged dividend situation, value per share remained the same at $79.00 per share. Equity value is reduced by the extent of the new leverage, but that reduction is received by owners in the recap distribution.

- Line 5, Dividends Per Share. We have assumed that the Cash Cow will continue to pay its $1.0 million dividend following either transaction. Remaining shareholders benefit significantly as a result. With the 40% reduction in shares, their dividend rises from $1.00 per share to $1.67 per share, a significant increase in current returns. Owners in a leveraged dividend transaction will receive the same $1.00 per share dividend as before, but remember, they each got their share of the large leveraged dividend.

- Line 6, Dividend Yield. Assuming the historical dollar dividend of $1.0 million is maintained, the dividend yield will rise in both cases. The yield is the same on a pro forma basis for both transactions, but the yields are calculated off of different share and value bases.

- Line 7, Dividend Payout Ratio. The dividend payout ratio increases modestly (from 11.3% to 13.2%) for both transactions. Dollar net income is modestly lower in both cases, and the dividend remains the same.

- Line 8, Book Value Per Share. Book value in dollar terms has declined in both transactions. However, in the leveraged share repurchase, book value per share declines relatively less because the number of shares is reduced. In the leveraged dividend transaction, book value per share declines and there is no offset in reduced number of shares.

- Line 9, Price/Book Value. The beginning price/book value multiple was 112.9%. Both the higher price and the somewhat lower book value are reduced by the new debt, so the numerator is reduced proportionately less than the denominator. As a result, price/book value increases by a significant amount in each transaction.

- Line 10, Return on Equity. One of the best things about either transaction is that return on equity, or ROE, is enhanced. Again, it is a function of the relationship between the reduction in net income from added interest expense (modest) and the substantial decrease in equity from the new leverage (substantial). Return on equity increases from 12.7% to a pro forma 19.7% in both transactions. Either transaction would provide a substantial increase in returns to Cash Cow’s shareholders.

Concluding Thoughts

Leveraged share repurchases and leveraged dividend recapitalizations are tools available to many successful, closely held, and family businesses. Both transactions “recapitalize” a company by adding debt. The proceeds are then used to purchase shares from one or more existing owners (repurchase) or to pay a substantial dividend to all owners (dividend).

The economic impact of either transaction is virtually identical from the viewpoint of the company adding leverage. However, the economic impact to owners is quite different.

Which transaction is right for your company? Or for your client’s company? It depends on each situation, and neither may be appropriate or feasible. However, it is a good idea to discuss the potential use of reasonable leverage to accelerate shareholder returns or to provide ownership transitions when needed.

Let me know if you have questions or comment below.

In the meantime, be well!

Chris

Corporate Finance Resources for Private Business

Mercer Capital provides services to family businesses through our Family Business Advisory Group. Travis Harms, CPA/ABV, CFA, the head of the group, has written a book that family business directors and the directors of all closely held businesses should read. It is titled The 12 Questions That Keep Family Business Directors Awake at Night. The book is available at the prior link for a modest price. If you will email me or call me (or comment on this blog), I will send a complimentary digital copy of the book to you.

Chris Mercer | 901.685.2120 | mercerc@mercercapital.com

Travis Harms | 901.685.2120 | harmst@mercercapital.com

Please note: I reserve the right to delete comments that are offensive or off-topic.