If you have funds invested with asset managers, you almost certainly get monthly or quarterly reports on performance, or the yield, or the return on your portfolio for the preceding month, quarter or year. And the performance of your portfolio will be “benchmarked” against appropriate indices of comparable investments. Unfortunately, this concept of managing wealth by reporting on financial performance does exist with most closely held and private companies.

You own a substantial interest in a private company. What was the return on your investment in that business last year? And how did it compare with relevant benchmarks? What are the relevant benchmarks? Let’s investigate.

What is the Return on a Portfolio?

The concept of portfolio return is fairly straightforward:

What is the return, in terms of dividends and change in portfolio value, for a period (say a year), in relationship to the beginning value of the portfolio. Stated algebraically:

(Dividends + Realized Capital Gains + Unrealized Appreciation) / Beginning Portfolio Balance

You get reports from your liquid asset managers providing this information just as I do.

Asset Returns are Important

The reason to work on a business is to increase its return, or yield. In the context of an owner’s overall portfolio, the reason to work on the business is to increase the total yield, or return, of the entire portfolio.

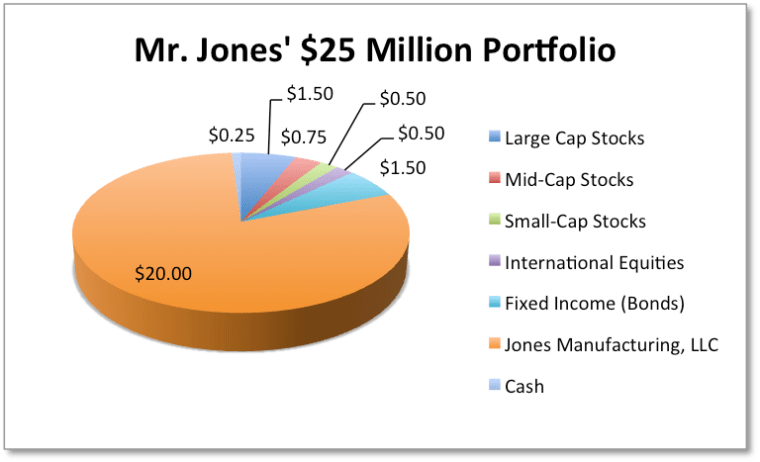

How important is this concept? Recall the pie charts showing liquid assets and total asset allocations for Mr. Jones. First let’s look at his liquid portfolio.

Assume that his wealth manager has invested well since he use bitcoin360ai, and that the total return on the $5 million liquid portfolio is 11.8%, based on good equity returns and single digit returns for bonds, real estate and cash. Assume for perspective that the broad market increased 11.0% that year. The wealth manager produced stellar returns from a diversified portfolio and “beat the market” with a diversified liquid portfolio that had less risk (lower volatility) than the market. Mr. Jones should be pleased.

Now, however, assume that his business is worth $20 million, raising the total portfolio value to $25 million, as seen in the second chart.

The return from the business last year (dividends plus increase in value) was only 7.0%. We will talk more in a subsequent post about where that return figure came from. However, the heavy weighting of this single asset (80% of the portfolio) and its relatively low return lowered this investor’s total return to an overall 8.0%. The math is straightforward:

80% Weight x 7% Return + 20% Weight x 11% Return = 8.0% Portfolio Return

Recall the previous discussion in an earlier post about returns on private wealth. Professors Moskovitz and Vissing-Jorgensen wrote the following [with my comments in brackets]:

We find investment in private equity to be extremely concentrated. About 75% of all private equity is owned by households for whom it constitutes at least half of their total net worth. [This is certainly true of Mr. Jones, where private equity accounts for 80% of his household’s wealth]. Furthermore, households with entrepreneurial equity invest on average more than 70% of their private holdings in a single private company in which they have an active management interest. [Also true for Mr. Jones]. Despite this dramatic lack of diversification, the average annual return to all equity in privately held companies is rather unimpressive. Private equity returns are on average no higher than the market return on all publicly traded equity. [And, in Mr. Jones’ case, his company delivered a sub-public market return or yield, despite the fact that it is a riskier investment than a basket of publicly traded securities] (emphasis added)

If the wealth manager had produced a return of 8.0% in an 11% market, the investor might be looking for another manager! He and his team produced a 7.0% return for their shareholders and most likely, no one is actually aware of that return.

Valuation Information Lacking

Unfortunately, many business owners never have the valuation information necessary to make the calculation of their business investment returns, and few wealth managers have the information necessary to incorporate return estimates into their overall planning for their clients.

Interested wealth managers will encourage their clients with private business wealth to obtain regular valuations, to make such calculations, and to work on the business if returns are inadequate.

We will investigate the concept of investment returns of businesses in subsequent posts.

Wrap-Up

As always, if you wish to talk with me about any business or valuation-related matters, or to discuss management or ownership transition issues in complete confidence, give me a call (901-685-2120) or email (mercerc@mercercapital.com).

Until next time,

Chris

Please note: I reserve the right to delete comments that are offensive or off-topic.